SERVICES

Actuarial & Risk Management Consulting

S G Actuarial Consultancy (Pvt) Ltd. offers Actuarial and Risk Management Consultancy Services to both Insurance and Non-Insurance Companies. Risk Management Support / Guidance offered is for any Company.

At present Services offered are more Strategic / Technical Support than an Appointed Actuary Role. The Company specializes in offering additional Internal Support on a Temporary / Project Basis. They are able to take on Life and General Insurance related work.

And all Projects will be handled personally by the Managing Director who is a Fellow Actuary.

The Consultancy has worked with 19 Companies.

Global CEO Interview

Consultancy Services Offered:

Insurance Companies

1. Internal Audit – Solvency Computation, Actuarial Valuation Model, Valuation Assumptions, Valuation Data, System, Products, Process / Practice improvements, Regulation / Internal Process Compliance

2. Offering Strategic Support to add value to the Client’s Operations

3. Supervising Internal Teams to carry out various Projects

4. Various Analysis. E.g. Profitability

5. Peer Review

6. Review Pricing work done internally

All Companies

7. Preparing / Reviewing Company Policy on areas such as Risk Management, Investments & Asset Liability Management, Operational Manuals

8. Support to establish / update a Risk Management and or Business Continuity Planning Process

9. Identifying Methods to improve the Processes and Procedures of the Client

10. Business Plan Creation / Review

Actuarial Training

S G Actuarial Consultancy (Pvt) Ltd. offers Group Actuarial Training Sessions mainly for Non-Actuarial Professionals.

The Standard Programmes presently offered are as follows:

- Actuarial for Non-Actuaries (Life Insurance)

- Actuarial for Non-Actuaries (Non-Life Insurance)

- Introduction to Actuarial Science

- Products from an Actuarial Viewpoint

- Life Insurance Financial Aspects

- Risk Management

- Board Training – Policy Liability & Surplus

- Life Insurance Processes

-

Risk Based Capital

-

Introduction to Pricing & Reserving (Non-Life Insurance)

-

Introduction to Actuarial Concepts (Life Insurance)

We are able to cater Training Programs as per Organization requirement as well as have Sessions exclusive for one Organization.

University of Ruhuna

Sessions are open to anyone interested in Actuarial Science who wish to gain a high level understanding of the Covered Topics.

We have trained participants from 116 Organizations. The Organizations are Insurance Companies, Regulatory Bodies, Fund Managers, and Software Developers, Banks, Insurance / Reinsurance Brokers, Reinsurance Companies, Wealth Management Companies, Stock Brokers, Finance Companies etc. And the Participants come from various backgrounds such as Finance, Operations / Technical, Underwriting / Claims / Product Development, Internal Audit, Compliance, Group, Marketing, IT, Risk Management, Actuarial, Legal, Investment etc

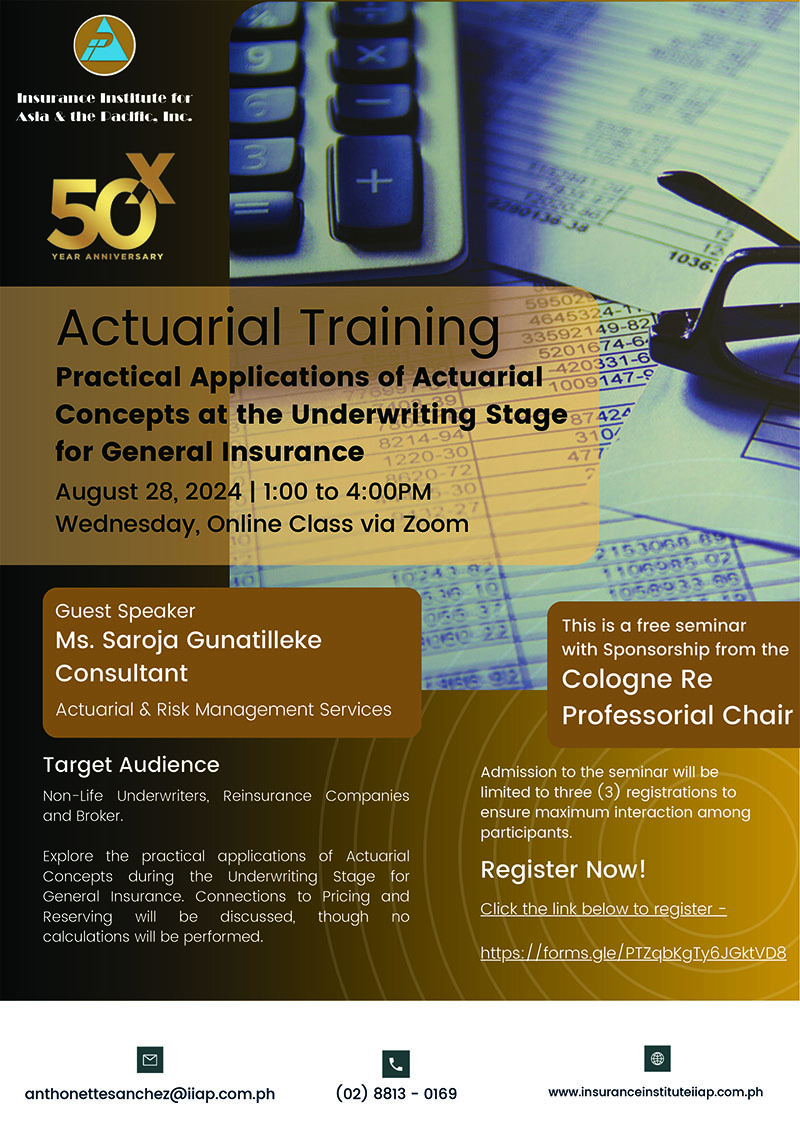

Overseas Participants are welcome and up to now, the Participants have been from 22 Countries.

The Training Sessions are at present, offered via Zoom and Face-to-Face either at the Client’s Office or in a Board Room environment.

All Training Sessions will be delivered personally by the Managing Director who is a Fellow Actuary.

Click here to read Reviews of the Training Programmes

International Webinars

Conferences

International Statistics Conference’ by IASSL

4th South Asian Actuarial Conference by AASL

4th South Asian Actuarial Conference by AASL

SLIIT Actuarial Conference

SLIIT Actuarial Conference

In-Person Training

Nepal CEOs

Overseas Insurance Regulator

Peradeniya University

Union Assurance

HNB Assurance PLC – Chief Managers and Head of Department

CT Smith / CT CLSA Securities, Wealth Management and Capital